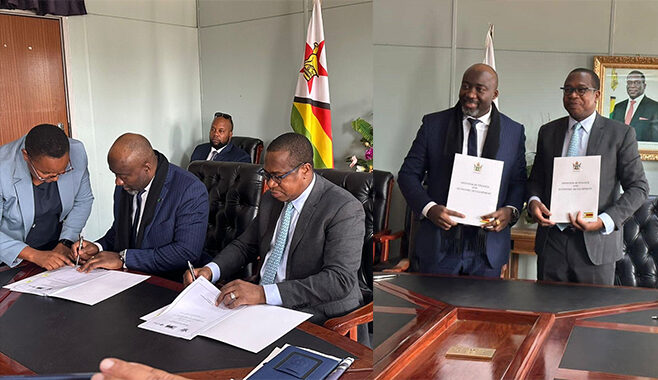

THE Zimbabwean Government has signed a Memorandum of Understanding (MOU) with One World Impact Investment Holdings Ltd, a global impact investor on Friday.

The MOU sets the stage for an extraordinary investment of up to US$3 billion over the next three years, aimed at supporting transformational low-carbon and climate-friendly development projects in Zimbabwe.

In a statement, the Ministry of Finance, Economic Development and Investment Promotion said: “This significant financing initiative will provide crucial support to key sectors including clean energy, transportation, agribusiness, real estate, and tourism.”

“The collaboration between the Zimbabwean government and One World Impact Investment Holdings Ltd represents a major milestone in the country’s sustainable development journey. The infusion of substantial funds will enable Zimbabwe to implement ambitious projects that promote a cleaner and more resilient future.”

Chronicle