FINANCIAL HIGHLIGHTS

Total Revenue – ZWG 2,680,952,842

Profit After Taxation – ZWG 1,008,277,932

Total Advances – ZWG 8,895,656,324

Total Assets – ZWG 30,046,505,805

Total Deposits – ZWG 18,505,883,184

Total Equity – ZWG 8,295,874,009

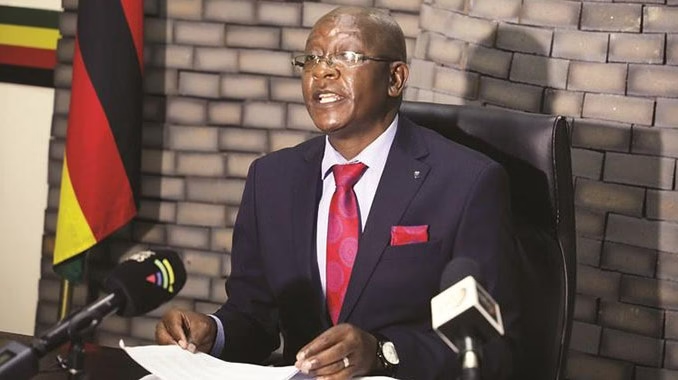

CBZ Holdings issued its trading update for Nine Months ended 30 September 2024 where the company’s performance revealed the benefits of diversification of product range.

Bouyed by its solid asset base of ZWG30.05 billion and a wide product range the company reduced its reliance on interest income. The company has a diversified product range spanning banking, insurance, investments, agro-business, digital services and philanthropy.

Non-interest income of ZWG1.80 billion was realised during the period under review. Net interest income amounted to ZWG880.02 million, supported by a loan portfolio of ZWG8.90 billion.

The company recorded a profit after tax of ZWG 1.01 billion with its income reaching ZWG2.68 billion for the nine months ended 30 September 2024.

The company reports that it has reached the minimum certification level under the Sustainability Standards Certification Initiative “SSCI”, and subsequently submitted its project for review by the certifying body.

Meanwhile the company has announced that it has been granted another extension by the Zimbabwe Stock Exchange (ZSE) to complete a mandatory offer to minority shareholders of First Mutual Holdings (FMHL) by November 30, 2024. The company acquired a 31,22 percent stake in FMHL from the National Social Security Authority (NSSA) and has made a mandatory offer to minority shareholders.

The company is expanding its foothold in the financial services and insurance sector

Looking ahead, the company commits to continue deploying its capital towards unlocking long-term value for its stakeholder