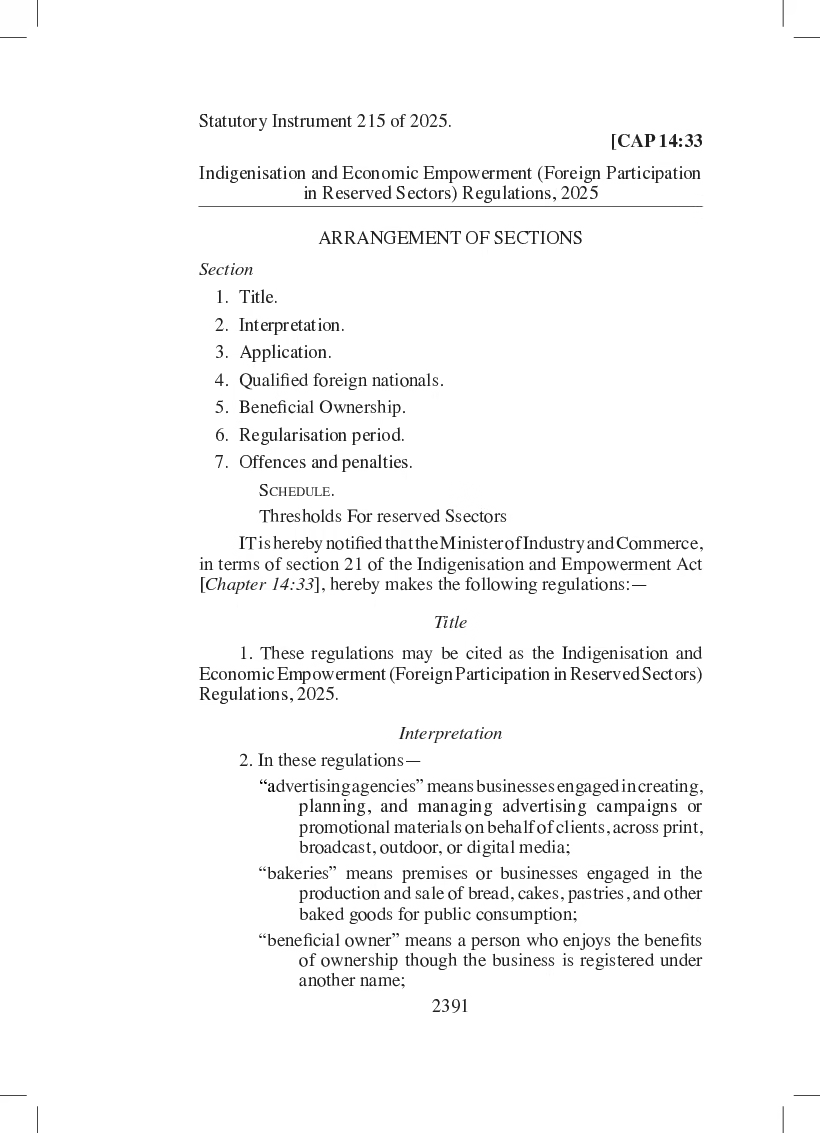

Statutory Instrument 215 of 2025 marks a significant policy moment in Zimbabwe’s ongoing indigenisation and economic empowerment agenda, setting out a detailed regulatory framework governing foreign participation in reserved sectors of the economy. Gazetted under the Indigenisation and Economic Empowerment Act, the regulations reaffirm Government’s intention to consolidate local ownership, deepen citizen participation and align economic activity with national development priorities.

At the core of the regulations is a clear policy position that certain sectors of the economy are exclusively reserved for Zimbabwean citizens. These include retail and wholesale trade, barber shops and hair salons, estate agencies, employment agencies, bakeries, grain milling below prescribed thresholds, tobacco grading and packaging, valet services, artisanal mining, borehole drilling and several transport related services such as taxis, car hire and passenger buses. In a limited number of sectors, foreign participation is permitted only under clearly defined thresholds or where international brands are involved, signalling a calibrated rather than blanket approach to economic protectionism.

The regulations introduce a robust definition of beneficial ownership, aimed at closing loopholes where businesses may be registered in one name while benefits accrue to undisclosed foreign interests. Businesses operating in reserved sectors are now required to make sworn declarations of beneficial ownership, supported by documentary evidence. This provision strengthens transparency, enhances regulatory oversight and curbs fronting arrangements that have historically undermined empowerment objectives.

For foreign nationals seeking to participate in reserved sectors, Statutory Instrument 215 establishes a permit-based system administered through the responsible Ministry. Applicants are required to demonstrate compliance with tax registration, banking regulations, investment licensing and to submit sound business plans that show measurable socio-economic benefits. These include employment creation, skills and technology transfer, value chain development and other nationally desirable outcomes. The Minister is empowered to approve, reject or attach conditions to such applications, reinforcing policy discretion in line with national interests.

A notable feature of the regulations is the regularisation period granted to foreign-owned businesses already operating in reserved sectors prior to the gazetting of the instrument. These entities are given a defined window to submit regularisation plans and, where required, to divest a minimum of 75 percent of equity to Zimbabwean citizens over a three-year period, in annual tranches of not less than 25 percent. This phased approach reflects an attempt to balance economic stability with the imperative of local ownership transformation.

Enforcement mechanisms are clearly spelt out. Operating in a reserved sector without a permit, making false declarations of beneficial ownership or failing to regularise operations attracts stiff penalties, including fines, imprisonment of up to five years, suspension or revocation of business licences and exclusion from Government procurement for up to five years. These provisions signal a shift towards stricter compliance and deterrence.

From a broader policy perspective, Statutory Instrument 215 aligns with the Second Republic’s emphasis on inclusive growth, value addition and citizen empowerment under the National Development Strategy framework. By ringfencing key sectors for locals while allowing structured foreign participation where it demonstrably adds value, Government is seeking to nurture indigenous enterprise, protect livelihoods and retain more value within the domestic economy.

While the regulations will likely spark debate within the business community, particularly among foreign investors and joint ventures, they provide clarity and certainty on where and how foreign capital can participate. Ultimately, SI 215 of 2025 underscores a strategic recalibration of Zimbabwe’s indigenisation policy, one that prioritises transparency, local ownership and sustainable economic development while maintaining room for foreign investment that aligns with national goals.